Table of contents

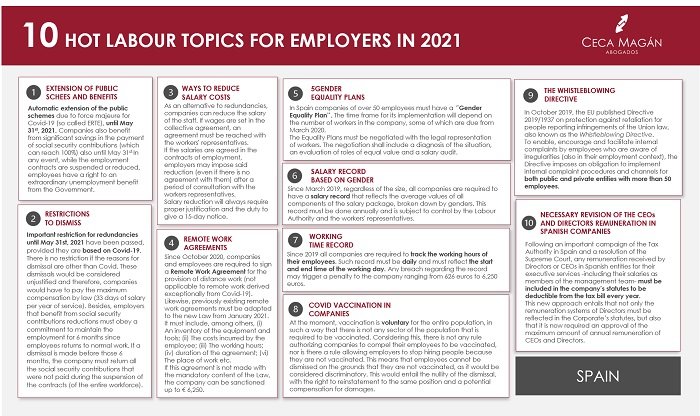

These are 10 hot topics in Employment Law in 2021:

1. EXTENSION OF PUBLIC SCHEMES AND BENEFITS

Automatic extension of the public schemes due to force majeure for Covid-19 (so called ERTE), until May 31st, 2021.

Companies also benefit from significant savings in the payment of social security contributions (which can reach 100%) also until May 31st.

In any event, while the employment contracts are suspended or reduced, employees have a right to an extraordinary unemployment benefit from the Government.

2. RESTRICTIONS TO DISMISS

Important restriction for redundancies until May 31st, 2021 have been passed, provided they are based on Covid-19. There is no restriction if the reasons for dismissal are other than Covid. These dismissals would be considered unjustified and therefore, companies would have to pay the maximum compensation by law (33 days of salary per year of service).

Besides, employers that benefit from social security contributions reductions must obey a commitment to maintain the employment for 6 months since employees returns to normal work. If a dismissal is made before those 6 months, the company must return all the social security contributions that were not paid during the suspension of the contracts (of the entire workforce).

3. WAYS TO REDUCE SALARY COSTS

As an alternative to redundancies, companies can reduce the salary of the staff. If wages are set in the collective agreement, an agreement must be reached with the workers’ representatives.

If the salaries are agreed in the contracts of employment, employers may impose said reduction (even if there is no agreement with them) after a period of consultation with the workers representatives.

Salary reduction will always require proper justification and the duty to give a 15-day notice.

REMOTE WORK AGREEMENTS

Since October 2020, companies and employees are required to sign a Remote Work Agreement for the provision of distance work (not applicable to remote work derived exceptionally from Covid-19). Likewise, previously existing remote work agreements must be adapted to the new Law from January 2021. It must include, among others, (i) An inventory of the equipment and tools; (ii) The costs incurred by the employee; (iii) The working hours; (iv) duration of the agreement; (vi) The place of work etc.

If this agreement is not made with the mandatory content of the Law, the company can be sanctioned up to 6.250 €

GENDER EQUALITY PLANS

In Spain companies of over 50 employees must have a ‘’Gender Equality Plan’’. The time frame for its implementation will depend on the number of workers in the company, some of which are due from March 2020.

The Equality Plans must be negotiated with the legal representation of workers. The negotiation shall include a diagnosis of the situation, an evaluation of roles of equal value and a salary audit.

SALARY RECORD BASED ON GENDER

Since March 2019, regardless of the size, all companies are required to have a salary record that reflects the average values of all components of the salary package, broken down by genders. This record must be done annually and is subject to control by the Labour Authority and the workers’ representatives.

WORKING TIME RECORD

Since 2019 all companies are required to track the working hours of their employees. Such record must be daily and must reflect the start and end time of the working day.

Any breach regarding the record may trigger a penalty to the company ranging from 626 euros to 6,250 euros.

COVID VACCINATION IN COMPANIES

At the moment, vaccination is voluntary for the entire population, in such a way that there is not any sector of the population that is required to be vaccinated. Considering this, there is not any rule authorizing companies to compel their employees to be vaccinated, nor is there a rule allowing employers to stop hiring people because they are not vaccinated.

This means that employees cannot be dismissed on the grounds that they are not vaccinated, as it would be considered discriminatory. This would entail the nullity of the dismissal, with the right to reinstatement to the same position and a potential compensation for damages.

THE WHISTLEBLOWING DIRECTIVE

In October 2019, the EU published Directive 2019/1937 on protection against retaliation for people reporting infringements of the Union law, also known as the Whistleblowing Directive.

To enable, encourage and facilitate internal complaints by employees who are aware of irregularities (also in the employment context), the Directive imposes an obligation to implement internal complaint procedures and channels for both public and private entities with more than 50 employees.

NECESSARY REVISION OF THE CEOS AND DIRECTORS REMUNERATION IN SPANISH COMPANIES

Following an important campaign of the Tax Authority in Spain and a resolution of the Supreme Court, any remuneration received by Directors or CEOs in Spanish entities for their executive services -including their salaries as members of the management team- must be included in the company’s statutes to be deductible from the tax bill every year.

This new approach entails that not only the remuneration systems of Directors must be reflected in the Corporate’s statutes, but also that it is now required an approval of the maximum amount of annual remuneration of CEOs and Directors.

Ana Gómez & Elena Alegría

Labour Law Department

Add new comment