Taxation poses a series of challenges and uncertainties for many companies from a legal standpoint: corporate taxes, taxation of digital assets, internationalization, changes in government criteria... and with a long road ahead in the courts. That is why having expert tax lawyers helps avoid unintentionally taking unnecessary risks and even facilitates long-term cost savings.

Tax advice for companies

Taxation in Mergers and Acquisitions (M&A):

- Tax advice on the planning and execution of corporate restructuring operations (mergers, spin-offs, asset contributions, securities exchanges, and other restructuring formulas) in search of the most efficient and beneficial solutions for our clients.

- Transfers and acquisitions of companies with the aim of optimizing the taxation of these transactions.

Tax inspections and tax proceedings:

- Tax inspections: representing and defending the client's interests before the tax inspectorate. Planning and executing the strategy to be followed both during the inspection and in any subsequent litigation.

- Management and collection procedures: advising and representing clients before the various tax authorities in the event of requests, value checks, parallel settlements, etc.

- Economic-administrative and judicial proceedings: representation and defense of clients' interests by our team of tax experts.

Tax law for all types of companies:

- Advice and planning in relation to corporate income tax (or non-resident income tax) and value added tax through the adoption of tax efficiency measures that facilitate the development of the company's business.

- Advice on special tax regimes such as SOCIMIs (Spanish REITs), foreign securities holding entities, venture capital entities, investment funds, etc.

- Advice on direct and indirect taxation matters related to the acquisition and subsequent management of debt portfolios.

- Withholdings on account of personal income tax, property transfer tax, stamp duty, etc.

Tax lawyers for family businesses

- Advice and planning for exemption from wealth tax and generational succession through the adoption of measures that facilitate this and minimize the tax costs of succession.

- Support in the transfer of family businesses.

- Analysis and advice on remuneration formulas for both family members involved in the management of the business and those who merely participate in the capital.

- Preparation and implementation of family protocols.

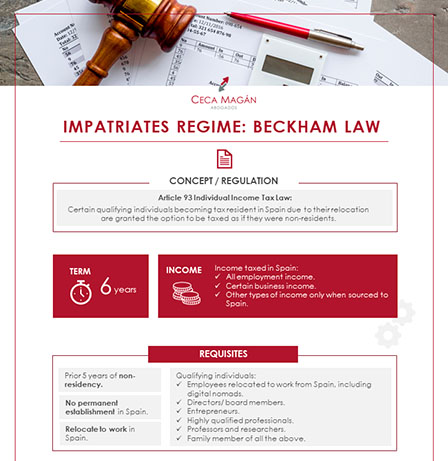

International Mobility and Tax Implications:

- Tax solutions for companies that manage the international mobility of their professionals, ensuring regulatory compliance and tax optimization in expatriation and impatriation processes.

- Taxation of international executives and advice from tax experts who ensure efficient tax planning according to the jurisdiction.

- When an employee is transferred to Spain or a third country, it is very important to take into account the labor aspects related to such an assignment in order to avoid problems. To this end, our firm has experts in labor matters.

International taxation:

- Advice and design of efficient tax strategies to optimize international investment and divestment structures.

- Secure repatriation of profits in accordance with current regulations and minimizing tax risks.

- Tax experts for the international expansion of your company.

Business collaboration in tax law:

- Asesoramiento en la fiscalidad de las diferentes fórmulas de colaboración empresarial: Agrupaciones de Interés Económico, Agrupaciones Europeas de Interés Económico y Uniones Temporales de Empresas.

Other tax services:

- Advice on planning personal income tax, wealth tax, and inheritance and gift tax with a view to minimizing, within the current legal framework, the tax burden on taxpayers and taking advantage of tax benefits.

- Analysis and optimization of the tax burden associated with financial products.

Contact our specialized tax lawyers

Our specialist tax lawyers are constantly updating their knowledge of regulations and doctrinal and jurisprudential trends related to taxation, as well as the main questions these raise for companies. To plan your company's taxation correctly, in terms of taxes, deductions, etc., contact us without obligation.

Análisis Técnico: Sentencias del Ámbito Tributario

- Noviembre 2021 - Declaración de inconstitucionalidad de la Plusvalía Municipal

- Julio 2020 - Efectos de la declaración de inconstitucionalidad del pago fraccionado mínimo

Análisis Técnico: Impuestos

- Septiembre 2020 - Guía Práctica de la Reforma del Impuesto de Sucesiones en Cataluña

Análisis Técnico: Actualidad

- Noviembre 2021 - Ley de Presupuestos Generales del Estado 2022

- Febrero 2021 - Enmiendas Proyecto de Ley de medidas de prevención y lucha contra el fraude fiscal

- Diciembre 2020 - Presupuestos, medidas de prevención y fraude fiscal

- Diciembre 2020 - Ley de Presupuestos Generales del Estado 2021

Si buscas prácticas o empleo en esta área de práctica, envía tu CV desde nuestro portal Únete a nosotros